The Ross Perot fallacy

The budget should not be balanced

With the 2024 presidential election cycle starting to look like a Trump-Biden rematch, many people are wishing for a third party candidate would rise up to challenge them. “Remember Ross Perot?” some ask. “He showed third parties can make a dent.” I supported him in both his runs for president, and unfortunately, boarded a train of logic that was headed in the wrong direction. Eventually, I realized the mistake.

In 1992, billionaire businessman H. Ross Perot launched an independent run for President of the United States against incumbent George Bush and Bill Clinton. Perot offered a folksy, populist message and captured 19% of the popular vote, which still stands as the most successful third-party run since Teddy Roosevelt in 1912.

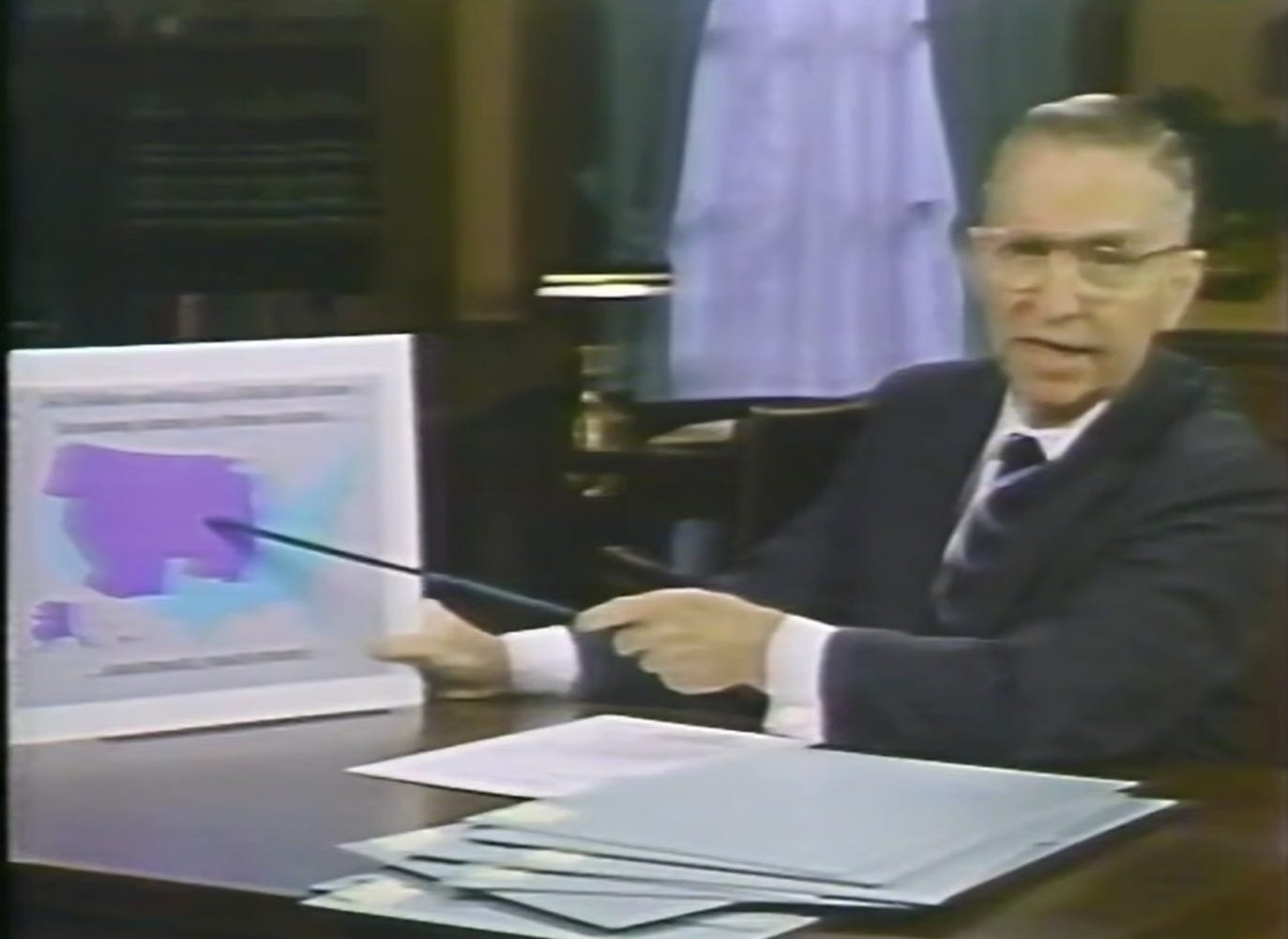

Perot bought prime-time television slots and used charts and graphs—the 90s version of a PowerPoint presentation—to deliver his message directly to the American people in a Texas twang. He called out the theory of trickle-down economics as bogus, identified how the US was spending more on healthcare than every other country but getting below average results, and criticized the ratio of CEO salaries to that of their employees. Perot pointed out America's military budget was the biggest in the world and childhood poverty was embarrassingly high compared to other industrialized nations.

It’s depressing that all of these problems are still with us three decades later.

“We’ve got to balance the budget.”

Perot's main point—even parodied on Saturday Night Live—was that deficit spending was unacceptable and unsustainable. The debt in 1992 made up 25% of our gross domestic product (GDP), and he predicted if this trend continued, by the far off year of 2020, it would be 42%! (In part due to the pandemic, the debt-to-GDP ratio that year was 133%.) But after rewatching the extant infomercials, one point about the national debt jumps out as obviously incorrect. “Four trillion,” Perot pontificated, “it’s gone; we don’t have much to show for it.”

Really? How could America have spent $4,000,000,000,000 and have nothing to show for it? Did we have a giant bonfire behind the White House, roasting marshmallows and hot dogs over smoldering bundles of $100 bills? Was it stashed under the mattress in the Lincoln bedroom?

This one fallacy was easy to gloss over among all the facts and figures which backed up the rest of Perot's presentation. In reality, Congress had pushed $4 trillion out across the United States, much of which was new money created specifically for that purpose, and of course it had received many, many benefits in return. It built infrastructure, delivered health care, and provided employment for millions of people, who then took their paychecks and spent them in other parts of the economy. There were no charts showing the health of the American economy during those 12 years; GDP had grown from $2.9 trillion in 1980 to $6.5 trillion by 1992.

Ross Perot convinced people that the federal budget should be balanced and that deficit spending was bad. This fallacy became baked into the financial dogma of Washington and even spurred bipartisan cooperation between Democrat Bill Clinton and the Republican Congress. Perot’s fiscal conservatism certainly made sense for the businesses he had built, it made little sense for the economy as a whole. The federal debt was last been at zero in 1835 under President Andrew Jackson, and the population had grown since then from 15 million to 250 million by 1992. Accordingly, additional money was needed in circulation, and Congress put it there through deficit spending, which Webster’s Dictionary defines as ‘government expenditures that exceed revenues.’

The Ross Perot fallacy presents a false dichotomy built on the erroneous assumption that deficit spending requires corresponding debt. The federal government has a third option when it comes to deficit spending; it can create money directly, to be used for expenditures independently from tax revenue. The Constitutional authority—indeed, the responsibility—to do so comes from Article 1, Section 8, and was used by Abraham Lincoln in the Civil War to issue legal tender, commonly called ‘greenbacks.’

Money is the lifeblood of the economy

Putting more dollars into circulation is a healthy thing, just like feeding a child is essential for their growth. A baby is born with only enough blood to fill a 12oz can; a pre-teen circulates two liters in their veins, and an adult might have two gallons of blood. To suggest the amount of blood should remain fixed would be medical malpractice; the idea that the amount of currency circulating should remain fixed is economic malpractice.

It is true creating too much money can cause inflation, but there are many factors which pull the economy in the opposite direction; productivity gains allow the creation of more goods for the same effort; new products divert the number of dollars chasing the same goods, and an increasing population expands the number of people producing goods and services. If the money supply stopped increasing, these factors would tip the scales toward deflation—an economic situation with its own set of problems.

To return to the analogy of feeding a child, it is true giving them too much food can cause obesity, but that requires a steady stream of poor decisions and a conscious effort to ignore the warning signs along the way. Similarly, if a child stopped eating, malnutrition would create a whole different set of health problems. As every parent knows, regular meals and a well balanced diet are key to a child’s proper development. Putting new money into productive places is just as essential for the American economy.

We’re doing money backward

Ross Perot also identified the real problem with the national debt – the interest we’re paying. In the just last three months of 2022, it was more than $210 billion. But he presented concerned Americans with the wrong solution. It's not the deficit spending that's the problem, it's the fact we're creating money as debt.

Congress made a policy decision to “borrow” into existence the dollars our growing economy depends on. There was no $31 trillionaire back in 1835, frustrated by the lack of debt and waiting to loan out their wealth. Similarly, if $31 trillion was sucked out of the economy today to “pay back the debt,” it would destroy our country. Those dollars were produced through an accounting fiction. This fiction is harming the American people by diverting hundreds of billions of dollars away from productive uses and into the pockets of the wealthy.

(Read more: A trillion dollar bill)

It’s time to change that policy to benefit every American, and replace our debt-based money with a 0% interest sovereign currency.

The budget should NOT be balanced

When we see through the Ross Perot fallacy, it’s easy to recognize the essential expansion of the money supply should be treated as a shared natural resource. It is the dividend from America’s growth in productivity and prosperity, and properly belongs to all of the citizens of the United States. The simplest, fairest, and most ethical way is to distribute these new dollars is as unconditional basic income (UBI).

(Read more: The Cantillon effect and UBI)

Ross Perot was correct about the other problems he identified, like the failures of trickle-down economics. UBI would create a trickle-up economy, eliminate the embarrassment of child poverty in the richest country in the world, and reduce the need for military spending as a way to push money into rural parts of the country.

He was also correct that neither Republicans or Democrats would address these problems. Because of Duverger’s law, our system of elections will continue to produce two major political parties, as it has since the 18th century.

A new way forward

The American Union of swing voters can change our political structure in 2024.

By crowdsourcing the legislative process, the gridlock and political corruption in Congress can be bypassed. Better public policy, including reform of the monetary system, can be written by the people, for the people. And as a union of swing voters, the ability to control the balance of power in the House, Senate, and Oval Office can be leveraged into legislative action before the election.

You can help make it happen by becoming a member of the American Union with a $7/month donation and a good faith pledge to vote together on November 5, 2024.

Thanks for sharing this with Hgsss Monday.

UBI is last resort. We need to spend the money on Essentials... like affordable housing neglected infrastructure Healthcare education a sustainable climate... those Investments would create living wage jobs.

Money creation can and should be divorced from the budget. This can be done by reducing payroll taxes on the fly and giving unbudgeted bonuses to welfare and pension recipients. This is important for two reasons:

1. It eliminates the very real concern that politicians will inflate the currency in order to pack the budget without raising taxes, and

2. The right amount of money to infuse into the budget must be adjusted weekly. We cannot know how much money to infuse a year in advance.